The fusion of luxury FintechZoom and technology has always fascinated the world, but when these elements meet within the financial sector, the result is the game-changing world of Luxury FintechZoom. In an era where digital innovation leads, high-net-worth individuals (HNWIs) are no longer satisfied with traditional financial services. They demand personalized, technologically advanced solutions to manage their wealth efficiently. That’s where Luxury FintechZoom enters the scene.

Luxury FintechZoom refers to the intersection of premium financial services and cutting-edge fintech solutions, designed to cater to the unique needs of affluent clients. These services combine convenience, exclusivity, and technological sophistication, reshaping the future of wealth management and luxury banking.

Luxury FintechZoom: The New Frontier of Wealth Management

Fintech has transformed the traditional banking landscape for all levels of consumers. However, for those with significant assets, generic solutions simply won’t suffice. Luxury FintechZoom addresses this gap by offering specialized, personalized, and intuitive financial services using AI, blockchain, and big data. These innovations enable wealth managers and financial advisors to offer tailored investment strategies, comprehensive risk management, and seamless financial transactions.

In today’s world, high-net-worth individuals expect more than a standard banking app. They seek tailored experiences that align with their lifestyles, including exclusive investment opportunities, instant liquidity, and enhanced security for large-scale transactions. Fintech platforms targeting the luxury market are focused on delivering these experiences seamlessly.

Key Features of Luxury FintechZoom

Luxury FintechZoom isn’t just about delivering fintech services to wealthy individuals. It’s about transforming how wealth management is perceived. Below are some defining features that make Luxury FintechZoom stand out in a saturated financial technology market:

The more assets a client has, the more complex their portfolio, but technology enables precise handling and real-time adjustments.

- Blockchain for Secure Transactions: Blockchain technology has become synonymous with security in financial transactions. High-net-worth clients require a system where transparency and privacy are paramount, especially when making multi-million-dollar transactions.

- High-Level Data Privacy: Given the stakes involved, privacy is not a luxury but a necessity for high-net-worth individuals. Luxury FintechZoom companies invest heavily in cybersecurity measures to protect clients’ sensitive information from hacks or data breaches, offering peace of mind alongside their services.

How Luxury FintechZoom Enhances Client Experience

Luxury FintechZoom is not just about efficiency but about creating an elevated, exclusive experience. Wealthy clients value time, personalization, and convenience, all of which are core to the services provided by luxury fintech firms. Here are several ways in which Luxury FintechZoom enhances the client experience:

- Real-Time Data and Analytics: Clients gain real-time access to their financial data, offering them greater control over their assets.

- 24/7 Advisory Services: Luxury fintech companies are increasingly integrating human touchpoints with 24/7 advisory services. This hybrid model blends AI-driven insights with human expertise, ensuring clients have constant access to financial advice, regardless of their location.

- Exclusive Access to Global Investment Opportunities: High-net-worth individuals are looking for opportunities to diversify their portfolios internationally. Luxury FintechZoom provides easy access to global markets and exclusive investment opportunities that aren’t available to the average investor.

- Tailored Digital Experiences: Whether it’s through high-end mobile apps or premium online platforms, luxury fintech services offer clients an intuitive and engaging user experience.

The Future of Luxury FintechZoom

The future of Luxury FintechZoom promises an exciting era for the elite class. With technological advancements evolving at a rapid pace, fintech solutions for high-net-worth individuals will only become more refined, providing more comprehensive, bespoke services. But what can we expect from Luxury FintechZoom in the coming years?

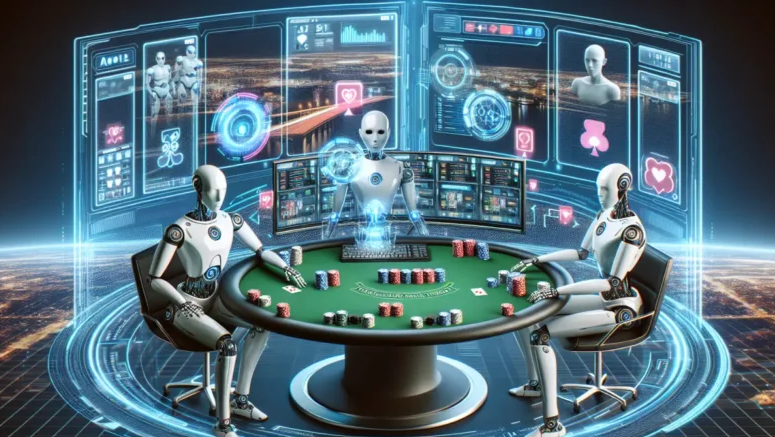

- AI in Full Control: While AI is already a significant part of fintech services, we can expect it to take on even more sophisticated roles in the future. Think autonomous wealth management platforms that not only analyze data but predict market movements with unprecedented accuracy and act accordingly without human intervention.

- Decentralized Wealth Management via Blockchain: As blockchain technology matures, its potential to disrupt traditional wealth management will increase. Blockchain can decentralize financial processes, giving clients more control and transparency over their assets while reducing the reliance on middlemen such as banks and brokers.

- Enhanced Personalization through Data: The role of big data will only expand in luxury fintech services. Expect platforms that leverage vast amounts of personal, financial, and behavioral data to craft ultra-personalized financial strategies and services that align perfectly with individual goals and desires.

The Challenges Facing Luxury FintechZoom

While the future of is promising, there are several challenges these fintech companies must navigate. One major hurdle is regulation. As fintech firms innovate, they must operate within regulatory frameworks that often lag behind technological advances. Moreover, they need to ensure compliance with international laws as many of their clients seek cross-border financial solutions.

Another challenge lies in cybersecurity. With vast amounts of wealth and sensitive data at stake, luxury fintech firms must remain vigilant against cyberattacks and ensure that their systems are impenetrable. High-net-worth individuals, in particular, are prime targets for hackers, making security protocols non-negotiable.

How Luxury FintechZoom is Different from Traditional Fintech

Traditional fintech is primarily focused on accessibility and innovation, democratizing financial services for everyone. It allows the average consumer to access banking, investing, and loans through apps and online platforms. However, takes a more exclusive approach, catering only to the top-tier clientele with personalized services, a high level of customer support, and an emphasis on luxury In contrast, luxury fintech platforms focus on a smaller user base, offering tailored solutions that go above and beyond the standard financial services. This might include everything from tax optimization to legacy planning and estate management.

Luxury FintechZoom in the Global Market

As luxury fintech gains traction, it’s quickly expanding across the globe, particularly in regions like North America, Europe, and the Middle East. Each market has its nuances in terms of client demands and regulatory environments. Luxury FintechZoom firms are adapting their offerings accordingly to meet the diverse needs of their global clients.

Conclusion

Luxury FintechZoom is redefining the financial landscape for high-net-worth individuals. By combining state-of-the-art technology with exclusive, tailored financial services, it offers a unique, elevated experience that goes beyond traditional banking.